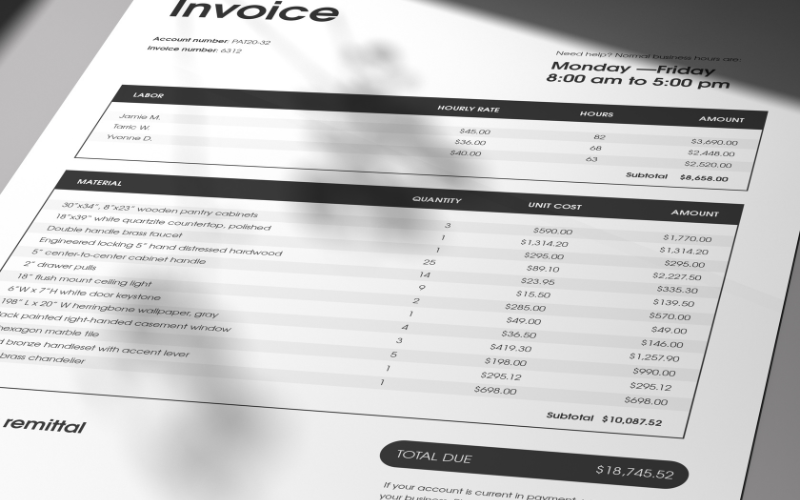

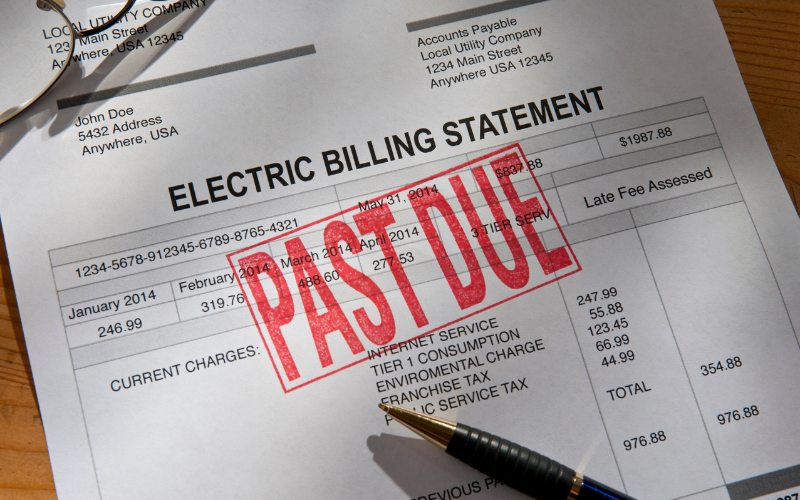

Gathering Documents – Collect all source documents related to your business’s transactions. Examples are invoices, receipts, bank statements and bills. These will therefore, serve as the basis for bookkeeping entries.

1. Invoices: Invoices show the sales transactions of your business. Therefore, this serves as the proof of income and organizing this will help track payments and manage accounts receivable.

2. Receipts: Receipts are the acknowledgment of payments made and received. They can, therefore, come from the expenses your business has incurred or from a customer who has settled an invoice. Consequently, when organized, receipts will verify payments and collections that will help to manage cash flow.

3. Bank Statements: These are official bank records detailing transactions for a specific account. In addition, the statements help in the reconciliation of your recorded cash position with the bank’s records. Doing the bank reconciliation process regularly will ensure accuracy in your financial records.

4. Bills: Bills represent the money your business owes. These documents are, therefore, necessary for managing debt, budgeting, and forecasting cash flow requirements.

Collecting and collating these documents provides numerous benefits. Moreover, it ensures all financial transactions are captured accurately which aids in compliance with legal and tax obligations. Additionally, it assists in financial analysis and decision-making by providing a clear picture of the financial health of the business. Furthermore, it enables effective cash flow management by highlighting upcoming receivables and payables. Consequently, it facilitates efficient audit trails, making it easier to trace transactions back to their source in case of discrepancies.

Categorizing Transactions – Determine the nature of each transaction. Subsequently, categorize them in relation to their impact on revenue, expenses, assets, liabilities, and equity.

Recording Transactions in Journals – Record each transaction in the journal. In addition, the journal is the book of original entry. Consequently, using the double-entry bookkeeping system ensures that debit and credit entries are equal.

Posting to Ledgers – Each account title used in the journal subsequently is transferred to their respective ledger accounts. Additionally, each ledger is a compilation of all transactions related to a specific account.

Adjusting Entries – Adjusting entries are done to make sure that all transactions have been recorded. Moreover, this usually happens at the end of an accounting period. Examples of these are necessary adjustments to account for expenses incurred or revenue earned that haven’t been recorded yet.

Preparing a Trial Balance – In order to catch any imbalances or errors in the ledger accounts a trial balance is prepared. Furthermore, a trial balance lists all the ledger accounts and their respective debit or credit balances. Consequently, these ensure that total debits equal total credits, indicating that the books are in balance.

Financial Statements – The preparation of the income statement, balance sheet, and statement of cash flows is easy once the trial balance is done. Accordingly, you lift the figures for the respective financial statements. This step will use the figures from the adjusted trial balance. Additionally, these will complete the information needed to illustrate the financial status of the business.

Closing Temporary Accounts – You “close” the revenues and expenses to the retained earnings account to signify the end of the accounting period. Additionally, “close” means the revenue and expense account balances are transferred to the retained earnings account. Consequently, this will result in zero balances in the temporary accounts to signal the start the new period.

Reconciliation – This step matches your bookkeeping records with external sources, such as bank statements. This is done to verify that your records are accurate and complete.

Record Retention – Safely store all financial records and documents in compliance with tax and legal requirements, as well as, internal business policies.

Regular Review – Periodically review the bookkeeping process, looking for inefficiencies or errors, and remain updated on regulatory changes that impact the process.

Bookkeeping is the systematic recording, organizing, and maintaining of financial transactions for a business. It is an essential process in which financial transactions are recorded systematically to keep track of income and expenditures, ensuring that a business’s financial records are accurate and up-to-date. This cycle includes several steps from initial documentation to the preparation of financial statements, to closing the books for a specific period.

By repeating this process every accounting cycle, usually monthly or quarterly, you ensure the financial health of your business is monitored and reported accurately.